Diminishing value depreciation formula

The DB function performs the following calculations. If you bought the asset partway through the year or if you do not use it 100 for business you also need to follow steps 3 and 4.

Depreciation Rate Formula Examples How To Calculate

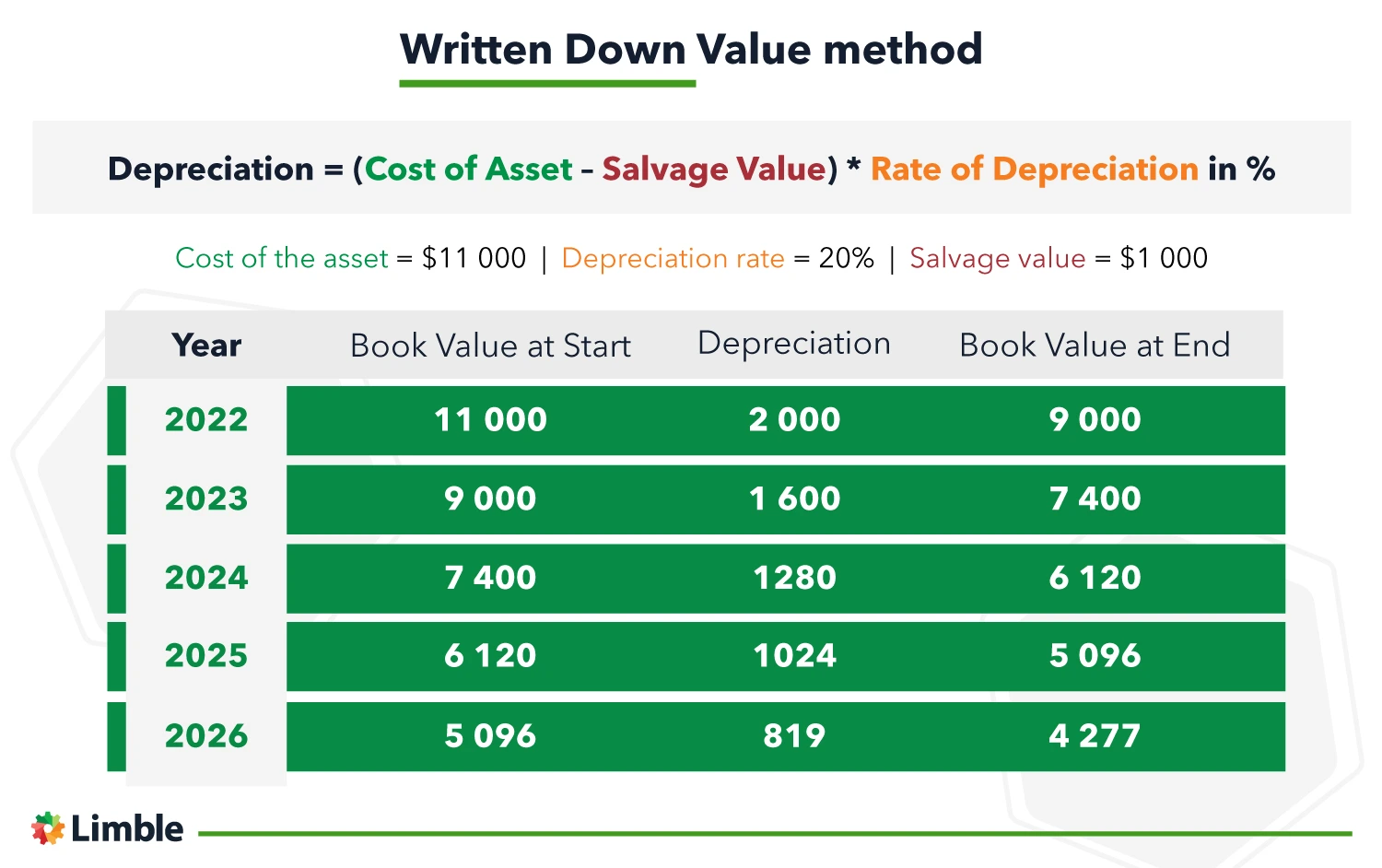

Net Book Value Scrap Value x Depreciation Rate Calculating Depreciation Expense using the Diminishing Balance Method.

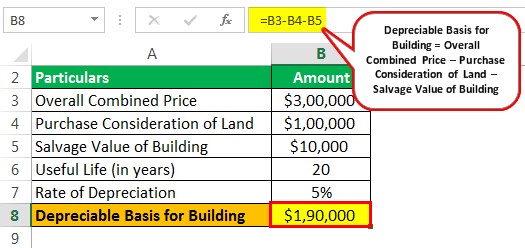

. The prime cost formula is as follows. What OOB depreciation method can be used for the diminishing-value method straight-line rate multiplied by 200 for depreciating assets - Base value days held 365 200 assets effective life. Diminishing balance Method Actual cost of AssetRate of depreciation100 13700020100 Depreciation Amount for 1 st year will be 2740000 Similarly we can calculate the depreciation amount for remaining years Calculation of Closing Value of 1 st year 137000-27400 10960000.

Prime Cost Depreciation Method The prime cost depreciation method also known as the simplified depreciation method calculates the decrease in value of an asset over its effective life at a fixed rate each year. Ad Insurance Total Loss Dispute Settlement - Diminished Value Claims. Is it something Australia-specific.

If you started to hold the asset before 10 May 2006 the formula for the diminishing value method is. Fixed rate 1 - salvage cost 1 life 1 - 100010000 110 1 - 07943282347 0206 rounded to 3 decimal places. The value of the asset being depreciated diminishes or reduces each year because this method users the book value of the asset for calculating the depreciation instead.

It uses a fixed rate to calculate the depreciation values. Diminishing Balance Method Example. Another common method of depreciation is the diminishing value method.

Non-ACRS Rules Introduces Basic Concepts of Depreciation. Rather depreciation is recalculated each year based on the assets depreciated value or book value. Diminishing value - depreciation Verified Hi.

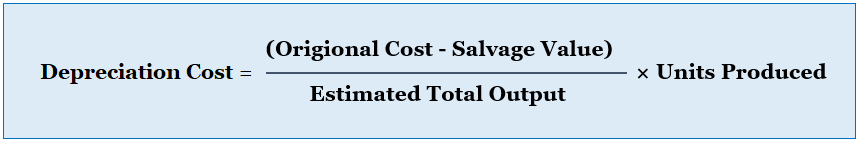

10000 Estimated Useful Life. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. Hence using the diminishing method calculate the depreciation expenses.

Diminishing balance method in accounting is the method by which the total amount of the depreciation can be calculated like some fixed percentage of the diminishing and reducing value of any asset that can stand in books during the beginning of an annual year so that it can bring the book value down to its initial. 465 5 votes. Financial Management Other Reply 2 Likes.

Calculate Diminishing Value Depreciation First Year diminishing value claim calculation. You might need this in your mathematics class when youre looking at geometric s. Calculate Diminishing Value Depreciation First Year diminishing value claim calculation.

Depreciation value period 1 10000 0206 206000. The rate of depreciation is 60. Diminishing Balance Method of Depreciation also called as reducing balance method where assets depreciate at a higher rate in the initial years than in the subsequent years.

When using this method assets do not depreciate by an equal amount each year. 80000 365 365 200 5 32000 For subsequent years the base value will reduce based on the difference between the current year and the next year. Diminishing value method.

Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. Option 2 - 6995 - Professionally formatted printable report for submission to. The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value Residual value X Depreciation Rate Here is the value of each element.

And the residual value is expected to be INR 24000. In this video we use the diminishing value method to calculate depreciation. Assets cost x days held 365 x 100 assets effective life.

Base value days held 365 150 assets effective life Reduction for non-taxable use. For the first year depreciate using. The following formula is used for the diminishing value method.

Of depreciation days minus the number of days. Pre-purchase Inspection - Free Consultation -Available Weekends - Call Now. This method results in accelerated depreciation and results in.

Under this method a constant rate of depreciation applies to an assets declining book value each year. This is best illustrated in an example. Cost value diminishing value rate amount of depreciation to claim in your income tax return The assets new adjusted tax value is its cost value minus how much depreciation youve claimed.

Net Book Value USD 105000 first year equal to the cost of the car Residual value USD 5000. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. Year 1 2000 x 20 400 Year 2 2000 400 1600 x 20 320 Year 3 2000 400 320 1280 x 20 256 And so on and so on.

The diminishing balance method of depreciation or as it is also known the reducing balance method calculates depreciation as a percentage of the diminishing value of an asset. Use the diminishing balance depreciation method to calculate depreciation expenses. Using the double-declining balance method however.

Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is- Depreciation Value. Under the straight-line depreciation method the company would deduct 2700 per year for 10 yearsthat is 30000 minus 3000 divided by 10. In this example the base value for the second year will be 80000 32000 48000.

Written Down Value Method Of Depreciation Calculation

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Formula Examples With Excel Template

Depreciation Schedule Formula And Calculator Excel Template

Double Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Equipment Depreciation Basics And Its Role In Asset Management

Depreciation Of Building Definition Examples How To Calculate

Grade 11 Financial Math Topic 5 Depreciation Youtube

Depreciation Formula Calculate Depreciation Expense

Depreciation Method Diminishing Method

Depreciation All Concepts Explained Oyetechy

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

Depreciation Formula Examples With Excel Template

Depreciation Schedule Formula And Calculator Excel Template

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Youtube Method Class Explained